seattle payroll tax calculator

Use the paycheck calculator to figure out how much to put. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

If You Need More Time To Complete Your 2017 Business Tax Return You Can Request An Extension Of Time To File Your Retu Tax Extension Business Tax Filing Taxes

Features That Benefit Every Business.

. Ad Choose Your Paycheck Tools from the Premier Resource for Businesses. Ad Payroll So Easy You Can Set It Up Run It Yourself. How to calculate annual income.

2022 Minimum Wage Calculator. Employers can file a tax return online. Just enter the wages tax withholdings and other information required.

Washington State Unemployment Insurance varies each year. Transportation Network Company TNC Driver Pay Calculator. While local sales taxes in Seattle Tacoma and some other metro areas are significantly higher than the national average.

Get the Paycheck Tools your competitors are already using - Start Now. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

Based Specialists Who Know You Your Business by Name. Seattle payroll tax calculator Wednesday June 8 2022 Edit. Use ADPs Washington Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Avalara calculates collects files remits sales tax returns for your business. Ad Compare This Years Top 5 Free Payroll Software. If you have more than 7 million in annual payroll expenses pay the tax on each employees wages over.

Seattles Payroll Expense Tax will begin on January 1 2021 and continuing to December 31 2040 applying rates ranging from 07 of payroll expenses up to 24 for companies with the. The City of Seattle Washington will impose a new employer-only Payroll Expense Tax effective 1 January 2021The filing of this tax was optional until Q4 2021and Zenefits is supporting this tax. At least one employee with annual compensation of 150000 or more.

All Services Backed by Tax Guarantee. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Washington. How to File a Tax Return.

The Washington bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Ad Payroll Made Easy. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Well do the math for youall you need to do is. Payments for the first quarter of 2022 are due on April 30. Washington Hourly Paycheck Calculator.

Calculate your Washington net pay or take home pay by entering your per-period or annual salary along with the pertinent federal. Get Started With ADP Payroll. For example if an employee earns.

However you still have to factor in Unemployment Insurance and Workers Compensation Tax. The City of Seattle passed a Commuter Benefits Ordinance which became effective on January 1 2020. Starting this month Seattles payroll tax will be collected quarterly.

Employers must calculate the Seattle payroll for all employees including those earning less than 150000. Get Started With ADP Payroll. 2021 Social Security Payroll Tax Employee Portion Medicare Withholding 2021 Employee Portion To contact the Seattle Department of Revenue please call 360-902-9620.

Ad Process Payroll Faster Easier With ADP Payroll. Seattles Department of Finance and. Your household income location filing status and number of personal.

Washington Paycheck Calculator Calculate your take home pay after federal Washington taxes Updated for 2022 tax year on Aug 02 2022. See it in action. Ad Process Payroll Faster Easier With ADP Payroll.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Washington Salary Paycheck Calculator. Free Unbiased Reviews Top Picks.

Ad Avalara AvaTax lowers risk by automating sales tax compliance.

Office Furniture Budget Template

Nanny Tax Payroll Calculator Gtm Payroll Services

Taxes For Freelance Developers How Much Tax You Should Pay As A Freelancer

Washington Paycheck Calculator Smartasset

1 600 After Tax Us Breakdown July 2022 Incomeaftertax Com

Nanny Tax Payroll Calculator Gtm Payroll Services

If You Are A Business Owner In Seattle Wa And Have Questions About Seattle Or Washington State Sales Tax Contact Us Budget Planning Sales Tax Accounting Firms

Washington Paycheck Calculator Smartasset

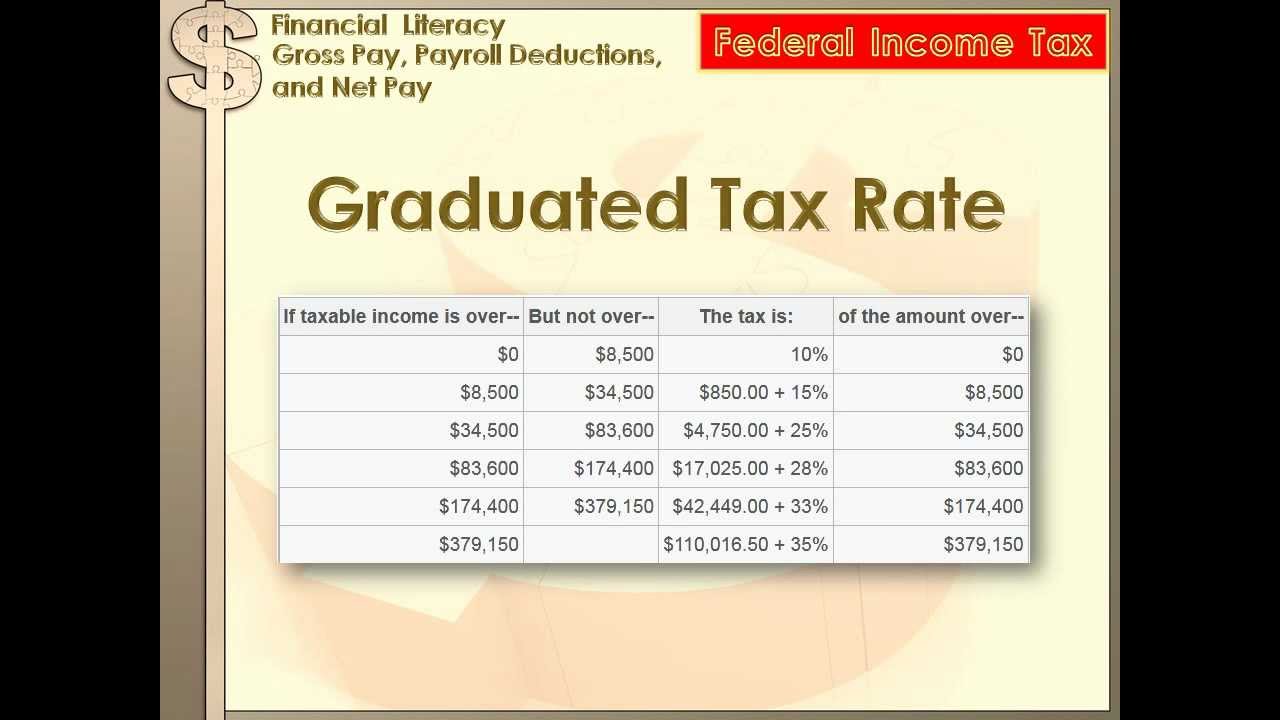

Financial Literacy Gross Pay Payroll Deductions Net Pay 8th Grade Math Youtube

How Much Does A Small Business Pay In Taxes

Equivalent Salary Calculator By City Neil Kakkar

Tax Calculator Estimate Your Taxes And Refund For Free

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Is A State With No Income Tax Like Washington Better Or Worse The Seattle Times

Why The Challenge To Seattle S Payroll Tax Will Fail And Should Fail Post Alley

Here S How Much Money You Take Home From A 75 000 Salary

5 6 Sales Tax Calculator Template

How To Calculate Your Real Cost Of Labor Remodeling

Remote Work Salary Calculator Airinc Workforce Globalization